Phone Number

(+91) 8655358999

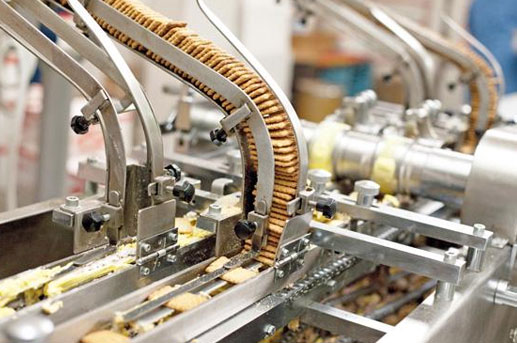

Food and beverage manufacturers must consider many factors: a consistently high level of product quality, maximum plant availability, optimum resource efficiency ŌĆō and, increasingly, the greatest possible flexibility in order to meet more and more individual customer requirements. Mastering all these challenges today and in the future is possible only with digitalization. We offer the products and solutions you need to fully or gradually integrate and digitalize your entire value chain.

The growth of food processing sector would need to be a significant component of the second green revolution, considering its possible role in achieving increased agricultural production by ensuring better remuneration for farmers. The food processing sector makes it possible by not only ensuring better market access to farmers but also by reducing high level of wastages.

A developed food processing industry will reduce wastages, ensure value addition, generate additional employment opportunities as well as export earnings and thus lead to better socioeconomic condition of millions of farm families.

Water is our number-one resource. Highly efficient wastewater treatment plants are essential for improving the water quality of our rivers, lakes and oceans and increasing the extremely small proportion of usable water. Above all, energy-intensive, complex wastewater treatment calls for energy-efficient, environmentally friendly and straightforward operations management of all areas of the plant. Whether youŌĆÖre planning new construction or modernization, we support you with hardware and software systems, comprehensive services and specialized expertise ŌĆō for an efficient, sustainable wastewater industry.

The level of contamination of domestic and industrial wastewater differs greatly chemically, biologically and with regard to solid matter.

This makes reprocessing extremely costly and time-consuming. As a planner and operator, your challenge is to design and operate a plant that is both economical and fit for the future. WeŌĆÖre ready to support you with our comprehensive range of products and individual solutions.

The study elucidates the situation of India and predicts the growth of its Pharmaceuticals industry. Report talks about growth, market trends, progress, challenges, opportunities, government regulations, technologies in use, growth forecast, major companies, upcoming companies and projects etc. in the Pharmaceuticals Sector of India. In addition to it, the report also talks about economic conditions of and future forecast of its current economic scenario and effect of its current policy changes in to its economy, reasons and implications on the growth of this sector. Lastly, the report is segmented by various types of Minerals and Metals available in the country.

The pharmaceuticals sector attracted foreign direct investment (FDI) inflows of US$ 13.34 billion between April 2000 and June 2015. Indian Government unveiled 'Pharma Vision 2020' program aimed to make India a global leader in drug manufacturing. Indian and global companies have expressed investment intentions worth US$ 150.84 million in the pharmaceutical sector in Gujarat State. The memorandums of understanding (MoUs) are signed during the Vibrant Gujarat Summit.

India is well recognized Pharmaceuticals manufacturing hub in the world because of its low cost production. Cheap labor, easy availability and low cost of raw materials and weak currency are the factors that are driving pharmaceutical Industry. Growing working population and expanding middle class are the main drivers for the growth of Pharmaceuticals industry in India.

Decisive factors driving the chemical industry include more efficient processes for commissioning plants more quickly, high productivity, availability and security over long plant lifecycles, and flexible production management. To optimally prepare you to meet these challenges, we offer a wide range of products and solutions all along the value chain. Thanks to digitalization, we can take into account measures during the planning phase already that are relevance for the commissioning, operation and possibly even future modernizations. This creates investment security and reduces the total cost of ownership. ŌĆ£We support chemical corporations in achieving more effective, cost-efficient, and sustainable operations with integrated Main Automation Vendor (MAV) and lifecycle management concepts.ŌĆØ

Reduction in costs. Greater production flexibility. More efficient processes. Increased plant availability. In the highly competitive market environment of the chemical industry, only one thing counts: competitiveness. As a reliable partner, we offer integrated and innovative electrification, automation, and digitalization solutions that enable you to make the best use of your competitive advantages.

The chemical industry is growing. By 2035, the market is expected to reach around 5.6 billion euros, more than double what it is today. Shorter product lifecycles, difficult access to raw materials, and high customer demands pose tremendous challenges for chemical companies.

Our highly innovative portfolio of electrical products, systems, solutions and services covers the entire lifecycle. A promise of supporting businesses like yours with future-proof solutions for the safe, efficient and reliable operation of commercial as well as naval vessels.

There are two geographical factors that put the Indian maritime sector at an advantageous position ŌĆō the vast coastline of 7,500 km and the strategic location along most major shipping highways. For years, the maritime routes have been used for trade and a show of strategic strength. Today, the country boasts of a modern shipbuilding and shipping sector, replete with all the variables necessary for overall industrial growth. Combined, these factors provide a strong basis to attract big investments in the Indian maritime sector.

While the positive signs of progress in the sector have opened up massive opportunities, they have also exposed bottlenecks to progress. It is crucial to unblock these bottlenecks and capitalise on the opportunities to give direction to the countryŌĆÖs maritime sector.

Nuvision business supports the Indian O&G sector in the Electrical & Automation space, in its efforts to become a world player. We provide integrated Electrical and Automation solutions. Our expertise spans the delivery of more than 45 terminals and over 18000 km of pipelines in India and overseas, by leveraging competencies in Electrical & Instrumentation, Fire & Gas, Control System, SCADA, Tank Farm management, Intrusion and Leak detection system, Surveillance, Emergency Shutdown (SIL3 & SIL4), variable frequency drivers and MIS.

The Oil and Gas (O&G) segment comprising crude oil, petroleum products and refineries is one of the core sectors of the Indian economy. It plays a significant role in the country's economic development as well as in addressing its energy concerns, and it is vital to have in place infrastructure such as import terminals, pipelines, intermediate storage terminals, etc. from source to consumers.

Paper production in India includes several types which are regularly and largely used in printing and packaging, writing, and a few specialty papers. Paper for printing and writing come as copier paper, super printing paper, bond paper, creame wove paper, map litho paper (surface size and non-surface), coating base paper and others. Paper for packaging includes boards, Kraft paper, posters and others. Other varieties are chromo paper/board, art paper/board and others. In India there are approximately 600 paper mills among which twelve are major players and also world renowned.

In India of total paper production 40% is from hardwood and bamboo fiber 30% is from agro waste other 30% from recycled material. Paper used for publications and Newsprint counts to 2 million tonnes. 1.2 million tonnes of newsprint are manufactured and the remaining is imported from other producers. It means that, about 40% of newsprint is brought in from outside the country.

Process automation in oil refineries is undergoing major changes, driven by customers frustrated by what they consider to be slow and incremental advances from the main automation original equipment manufacturers (OEMs) in the industry. ExxonMobil has become a de facto industry representative and is driving vendors like Yokogawa and others to reevaluate how large-scale automation projects are implemented.

The customer message is clear: projects take too long; they are too engineering-intensive; and the automation systems frequently become the critical path in the final stages, often causing the project to fall behind schedule. In many instances, automation engineers can legitimately point at process engineers and others for last-minute changes, but with little consolation from the owners.

As a result, automation OEMs are being guided by the industries they serve to develop and improve solutions that provide the reliability, operability and safety expected from control system platforms. OEMs are also being asked to improve methodologies for assembling, executing and deploying a complex process solution with improved efficiency, lower installation cost and greater adherence to schedule.

As a trusted mining partner, Nuvision solutions help customers to meet their challenges and thereby enable to set new benchmarks within the mining industry. To boost efficiency and reduce costs, we rely on our solutions for mine hoists, bulk material handling, gearless and conventional mills as well as mining-specific automation and power solutions. SIMINE solutions additionally offer solutions for the digitalization of your plants, machinery, and processes which optimize operations and ensure consistent, end-to-end data management.

Mining operations produces valuable minerals or geological materials from the Earth. Economical recovery often requires high throughput and high availability of the process with low operation costs, and stringent safety and environmental regulations.

Nuvision measurement and analytical solutions comprise of a wide portfolio of flow, pressure, temperature and level sensors, water and gas analyzers, plus industry trusted recorders and controllers. They are all designed to help food and beverage producers maximize the performance of their plant.

In the mid 2011, Nuvision entered the power business with the release of the Electric Control System. Since then, Nuvision has steadfastly continued with the development of our technologies and capabilities for providing the best services and solutions to our customers worldwide.

IndiaŌĆÖs power sector is one of the most diversified in the world. Sources of power generation range from conventional sources such as coal, lignite, natural gas, oil, hydro and nuclear power to viable non-conventional sources such as wind, solar, and agricultural and domestic waste. Electricity demand in the country has increased rapidly and is expected to rise further in the years to come. In order to meet the increasing demand for electricity in the country, massive addition to the installed generating capacity is required.

Power is one of the most critical components of infrastructure crucial for the economic growth and welfare of nations. The existence and development of adequate infrastructure is essential for sustained growth of the Indian economy.

The oil and gas sector is among the eight core industries in India and plays a major role in influencing decision making for all the other important sections of the economy. IndiaŌĆÖs economic growth is closely related to energy demand; therefore the need for oil and gas is projected to grow more, thereby making the sector quite conducive for investment.

The Government of India has adopted several policies to fulfil the increasing demand. The government has allowed 100 per cent Foreign Direct Investment (FDI) in many segments of the sector, including natural gas, petroleum products, and refineries, among others. Today, it attracts both domestic and foreign investment, as attested by the presence of Reliance Industries Ltd (RIL) and Cairn India.

The Gross Value Added (GVA) at basic current prices from the manufacturing sector in India grew at a CAGR of 4.34 per cent during FY12 and FY18 as per the second advance estimates of annual national income published by the Government of India. During April-September 2018, GVA from manufacturing at current prices grew 14.8 per cent year-on-year to Rs 138.99 trillion (US$ 198.05 billion). Under the Make in India initiative, the Government of India aims to increase the share of the manufacturing sector to the gross domestic product (GDP) to 25 per cent by 2022, from 16 per cent, and to create 100 million new jobs by 2022. Business conditions in the Indian manufacturing sector continue to remain positive.

Manufacturing has emerged as one of the high growth sectors in India. Prime Minister of India, Mr Narendra Modi, had launched the ŌĆśMake in IndiaŌĆÖ program to place India on the world map as a manufacturing hub and give global recognition to the Indian economy. India is expected to become the fifth largest manufacturing country in the world by the end of year 2020*.